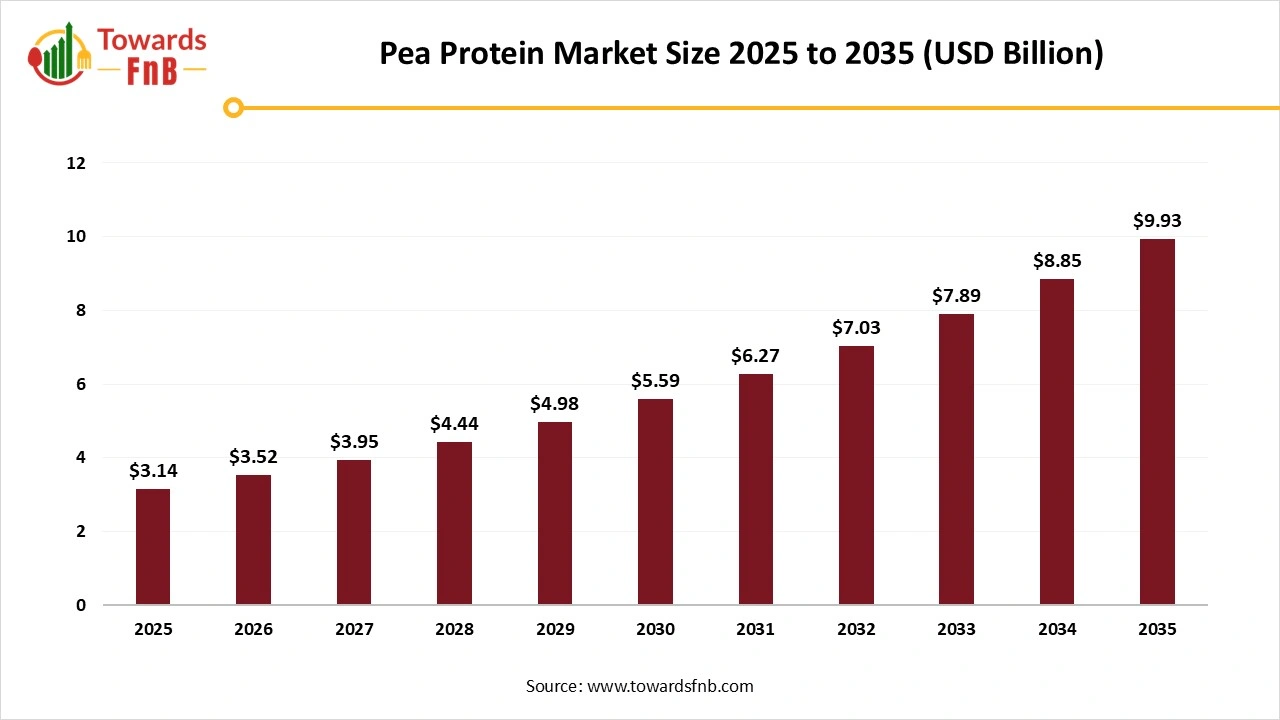

Pea Protein Market Size to Worth USD 9.93 billion by 2035 | Towards FnB

According to Towards FnB, the global pea protein market size is calculated at USD 3.52 billion in 2026 and expand to approximately USD 9.93 billion by 2035, advancing at CAGR of 12.2% from 2026 to 2035. This growth trajectory reflects the accelerating commercial adoption of pea protein across food, beverage, and nutrition applications.

Ottawa, Jan. 22, 2026 (GLOBE NEWSWIRE) -- The global pea protein market size stood at USD 3.14 billion in 2025 and is predicted to grow from USD 3.52 billion in 2026 to reach around USD 9.93 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to the increasing population of health-conscious consumers, vegans, and vegetarians, resulting in higher demand for plant-based protein options. The market is also expected to grow due to rising technological advancements, which are helpful for enhanced protein extraction and also fuel the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5981

Key Highlights of Pea Protein Market

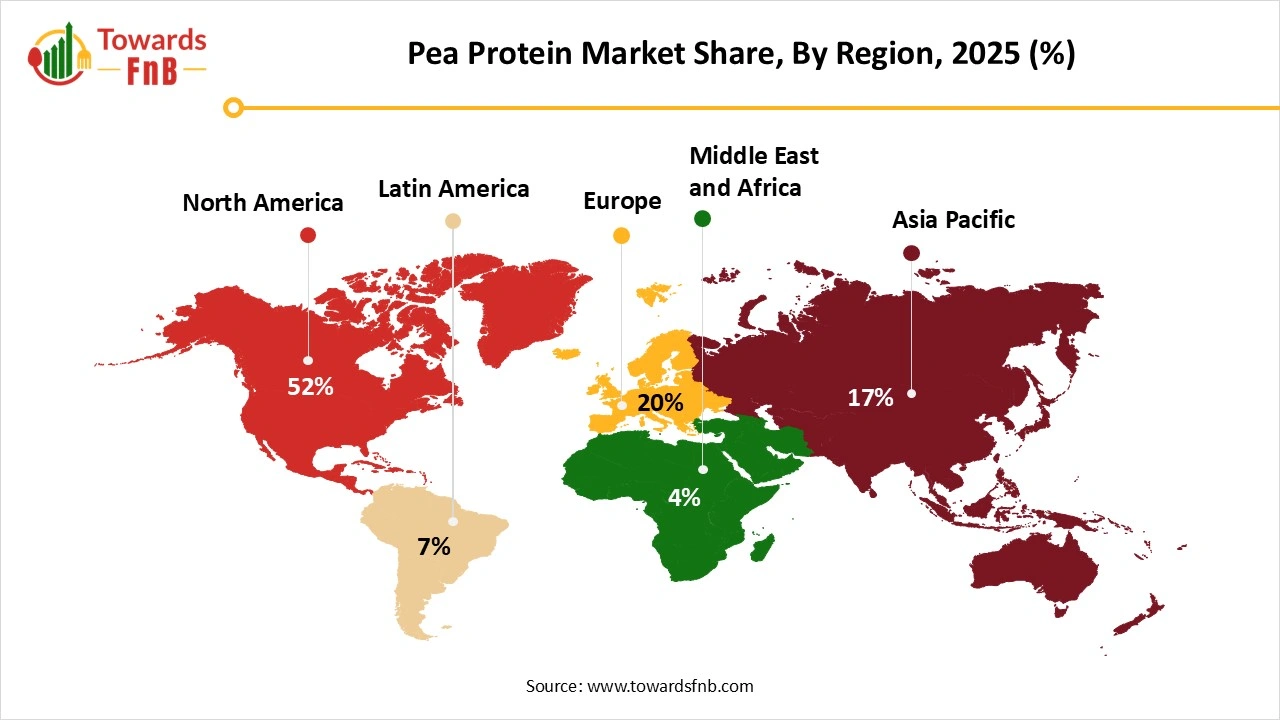

- By region, North America accounted for the largest share of the global pea protein market, capturing 52% in 2025.

- By region, Asia Pacific is anticipated to register the fastest CAGR during the 2026–2035 period.

- By type, the pea protein isolate segment led the market with a 43.8% share in 2025.

- By type, the textured pea protein segment is forecast to grow at the highest CAGR between 2026 and 2035.

- By form, the dry segment dominated the market, representing 72.4% of total revenue in 2025.

- By form, the liquid segment is expected to expand at the fastest CAGR over the forecast period.

- By application, the food & beverages segment held a leading market share of 38.5% in 2025.

- By application, the dietary supplements segment is projected to witness the fastest CAGR during the forecast timeframe.

- By source, yellow split peas emerged as the leading source, accounting for 62.4% of the global market in 2025.

- By source, the lentils segment is expected to grow at the fastest CAGR from 2026 to 2035.

Higher Demand for Plant-based Options Fueling the Growth of the Market

The pea protein market is expected to grow due to the growing population of health-conscious consumers, leading to higher demand for plant-based diets, which is one of the major factors for the growth of the market. The market also observes growth due to the availability of multiple plant-based protein options in various forms, allowing vegans, vegetarians, and flexitarians to choose from a variety of options. Higher demand for clean-label ingredients and sustainable options also helps to fuel the growth of the market.

Technological Advancements Are Helpful to Fuel the Growth of the Pea Protein Market

Technological advancements help in the easy and effective manufacturing of protein-rich plant protein options, fueling the growth of the market. Technologically advanced processing options, such as high-pressure processing, pulsed electric field, precision fermentation, 3D extrusion, and ultrasonic technology, help to enhance the product quality and maintain the nutritional profile of the product, further fueling the growth of the market.

Impact of AI in the Pea Protein Market

Artificial intelligence is increasingly shaping the pea protein market by improving protein extraction efficiency, functional performance optimization, and formulation consistency across food, beverage, and nutrition applications. Machine learning models analyze variability in pea varieties, protein fractions, starch content, and fiber composition to optimize wet and dry fractionation processes, helping manufacturers maximize protein yield while controlling off-notes and color variation. In product development, AI supports functionality mapping by predicting how different pea protein isolates and concentrates behave in applications such as meat analogs, dairy alternatives, and beverages, particularly with respect to solubility, gelation, emulsification, and thermal stability. AI-driven process control systems are also deployed during extraction, purification, and drying stages to monitor parameters such as pH, temperature, shear, and moisture content, reducing batch inconsistency and energy use.

From a sensory and quality standpoint, AI models correlate instrumental data with sensory outcomes to mitigate bitterness, beany flavor intensity, and texture defects before scale-up. In regulatory and safety workflows, AI assists in allergen risk screening, labeling validation, and specification management in line with guidance referenced by the Food and Agriculture Organization and regulatory oversight applied by bodies such as the European Food Safety Authority. Overall, AI acts as a yield optimization and performance-standardization layer in the pea protein market, enabling suppliers to improve cost efficiency, expand application suitability, and deliver more consistent plant-based protein ingredients at commercial scale.

Recent Developments in Pea Protein Market

- In June 2025, Meala FoodTech announced the launch of Vertis PB Pea, a plant-based texturizing pea protein. It is an alternative to traditional binders in meat alternative formulations.

- In December 2025, Lasenor, a bakery solutions firm, announced the launch of their texturing pea protein designed to reduce the egg use by 50-100% in muffins, cakes, and other baked goods.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/pea-protein-market

New Trends of Pea Protein Market

- Growing health, ethical, and environmental concerns leading to higher demand for pea protein options is one of the major factors for the growth of the market.

- Higher demand for clean-label, non-GMO, natural, and organic options is another major factor for the growth of the market.

- Technological advancements are helpful for easy extraction of protein and maintaining the quality of the product, also helping to fuel the growth of the market.

Product Survey of the Pea Protein Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Pea Protein Isolate | Highly purified pea protein with high protein concentration and low carbohydrate content | Powdered isolates, instantized forms | Sports nutrition, protein supplements, RTM foods | Pea protein isolate ingredients |

| Pea Protein Concentrate | Moderately processed pea protein retaining some fiber and starch | Powdered concentrates | Bakery products, snacks, plant-based foods | Pea protein concentrate products |

| Textured Pea Protein | Structured pea protein designed to mimic meat-like texture | Chunks, granules, flakes | Plant-based meat manufacturers | Textured vegetable protein from pea |

| Hydrolyzed Pea Protein | Enzymatically treated pea protein for improved solubility and digestibility | Liquid and powder hydrolysates | Beverages, clinical nutrition, infant nutrition | Hydrolyzed pea protein systems |

| Organic Pea Protein | Pea protein produced from certified organic yellow peas | Organic isolate and concentrate forms | Organic and clean-label food brands | Certified organic pea protein |

| Instantized Pea Protein | Agglomerated protein designed for rapid dispersion in liquids | Instant powders | Protein shakes, meal replacements | Instantized pea protein powders |

| Pea Protein Blends | Blended formulations combining pea protein with other plant proteins | Pea–rice, pea–fava blends | Balanced amino acid food formulations | Multi-plant protein blends |

| Functional Pea Protein | Modified pea protein optimized for emulsification or foaming | Functionalized protein systems | Bakery, sauces, dairy alternatives | Functional pea protein ingredients |

| Pea Protein for Dairy Alternatives | Pea protein tailored for milk, yogurt, and cheese analogs | Beverage-grade and gel-forming variants | Plant-based dairy manufacturers | Pea protein dairy-alternative systems |

| Specialty Pea Protein | Application-specific pea protein developed for targeted performance | High-gel or high-solubility variants | Infant nutrition, medical nutrition | Specialty pea protein formulations |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5981

Pea Protein Market Dynamics

What Are the Growth Drivers of the Pea Protein Market?

The growing population of vegans, vegetarians, and plant-based diet followers is one of the major factors for the growth of the market. Easy availability of plant-based protein options in various forms in retail stores and online platforms also helps to fuel the growth of the market. Higher demand for plant-based, clean, and protein-rich options also helps to fuel the growth of the market. Plant-based protein also helps to lower the carbon footprint for the manufacturing industries compared to animal-based protein; hence, it also helps to maintain sustainability, further fueling the growth of the market.

Supply Chain and Production Issues Hampering the Growth of the Market

Climatic issues leading to issues in crop yield are one of the major restrictions in the growth of the market. Geopolitical problems, along with harsh climatic conditions such as heavy rainfall or drought, also hamper the market’s growth. High costs incurred in the manufacturing of plant-based protein options also restrain the growth of the market. Such factors altogether may hamper the growth of the market.

Higher Availability of Plant-Based Meat Alternatives Is Helpful for the Growth of the Market

Higher availability of options such as vegan meat, sausages, and burger patties for vegans and vegetarians also helps to fuel the growth of the market. The growing population of flexitarians in search of plant-based protein options also helps to fuel the growth of the market. Higher demand for dairy-free options and their easy availability on various platforms also help to fuel the growth of the market.

Pea Protein Market Regional Analysis

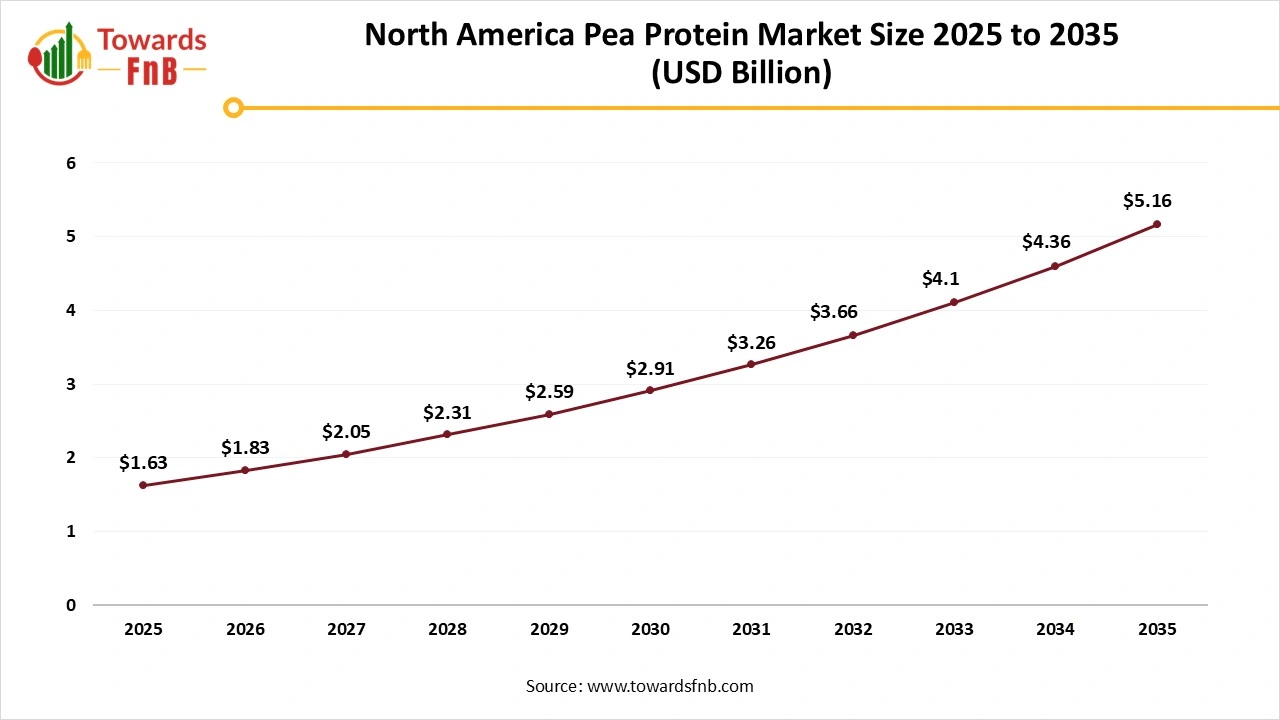

North America Dominated the Pea Protein Market in 2025

North America led the pea protein market in 2025, due to higher demand for innovation and evolving dietary preferences. The growing population of vegans, vegetarians, and flexitarians also helps to fuel the growth of the market. Higher consumption of pea-based food and beverages due to their higher protein content and high nutritional profile in the region also helps to fuel the growth of the market. The US has made a major contribution to the growth of the market due to rising health issues observed in the region due to excessive red meat consumption, leading to higher demand for plant-based protein options.

Asia Pacific Is Observed to Be the Fastest-Growing Region in the Foreseen Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to rising consumer awareness regarding the benefits of plant-based protein options and greater changes in consumer preferences, leading to the growth of the market. Higher preference for protein-based options to maintain a healthy lifestyle by consumers lately also helps to fuel the growth of the market. The growing population of vegans, vegetarians, and plant-based diet followers also helps to fuel the growth of the pea protein market in the foreseeable period. Availability of novel and healthier food options by multiple food and beverage brands also helps to fuel the growth of the market in the foreseeable period. India is observed to have a major contribution in the growth of the market due to the growing population of health-conscious consumers, along with plant-based diet followers.

Europe Is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to lifestyle-related health issues observed in the region and the growing importance of plant-based protein options, fueling the growth of the market. The growing population of vegans, vegetarians, and flexitarians also helps to fuel the growth of the market. The UK has made a major contribution to the growth of the market due to higher demand for various plant-based options, such as protein bars, snacks, and plant-based meat alternatives.

Trade Analysis for the Pea Protein Market

What Is Actually Traded (Product Forms and HS Proxies)

- Pea protein isolates and concentrates used in food and beverage formulations, supplements, and plant-based products are commonly traded under HS 35040099 (protein isolates including pea protein isolates) and HS 21061000 (food preparations not elsewhere specified including protein concentrates).

- Dry pea protein flours and textured pea proteins used in meat alternatives, baking, and snacks are often classified under HS 350400 and HS 210610 depending on processing and formulation specifics.

-

Pea protein derivatives for specialized applications (e.g., high-purity isolates for infant nutrition or supplements) may also be traded under combined food preparation codes when supplied as compound products. (Custom trade practice inference based on global commodity data).

Pea protein ingredient blends supplied to manufacturers for blending with other plant proteins are typically cleared under HS 21061000 as composite food preparations. - Packaging components and ancillary ingredients for pea protein shipments such as sacks and bagged containers are traded under separate headings (e.g., HS 3923) separate from the protein content itself.

Top Exporters (Supply Hubs)

- China: Largest global exporter of pea protein shipments, accounting for a significant share of world exports and supplying major import markets.

- Belgium: Major exporter of processed pea protein ingredients into European and global food ingredient supply chains.

- India: Significant exporter of pea protein, particularly to markets in Asia and North America.

- France: Notable exporter of pea protein and specialty isolates to food manufacturers across Europe and beyond. (Inferred from trade proxy export patterns and European ingredient trade dynamics).

-

United States: Exporter of specialized pea protein isolates and blended ingredients used in supplements and plant-based foods. (Inferred from global trade data trends and import/export shipments).

Top Importers (Demand Centres)

- United States: Largest importer of pea protein, sourcing high volumes for food processing, nutritional products, and plant-based meat alternatives.

- India: Major importer of pea protein concentrates and isolates, driven by expanding food processing and nutrition markets.

- Mexico: Growing importer supporting food and beverage manufacturing needs.

- Vietnam: Importer of pea protein for food ingredient and processing sectors, reflecting broader Asia Pacific demand.

-

European Union: Strong importer as a whole due to robust plant-based food manufacturing and high-protein ingredient demand (aggregate trade practices in food ingredient imports).

Typical Trade Flows and Logistics Patterns

- Finished pea protein products (powder isolates and concentrates) are shipped via containerized sea freight from production hubs to major demand centres, leveraging established international ingredient supply routes.

- High-value pea protein isolates and specialty blends may be shipped by air freight to meet rapid production timetables and preserve quality.

- Bulk shipments frequently go to regional distribution hubs for repackaging, extension of shelf life, and compliance labelling prior to delivery to food manufacturers.

- Importers often combine shipments of pea protein with other plant-based ingredients to optimise freight efficiency and formulation delivery.

Trade Drivers and Structural Factors

- Growth in plant-based foods and alternative proteins increases demand for pea protein as a key ingredient in meat alternatives, dairy alternatives, snacks, and nutrition products.

- Rising health and wellness consumption patterns support expanded use of pea protein in fortified foods and dietary supplements.

- Price competitiveness and availability of raw peas influence sourcing and trade flows for processing.

- Expansion of food processing infrastructure in emerging markets supports imports of high-performance pea protein isolates.

- Standardisation of high-protein ingredient specifications by large food manufacturers drives repeat import demand.

Regulatory, Quality, and Market-Access Considerations

- Pea protein ingredients must comply with food safety and additive regulations in importing countries, including purity specifications, protein content labelling, and allergen declarations.

- Classification under specific HS codes influences duty treatment and documentation requirements during customs clearance.

- Functional claims (e.g., “high protein” or “plant-based”) are subject to national labelling rules that affect market access.

- In some markets, novel food or ingredient approval pathways may apply to concentrated pea protein isolates.

Government Initiatives and Public-Policy Influences

- Agricultural policies that support pulse production (e.g., duty-free yellow pea imports in some timelines) influence raw material availability for pea protein processing.

- Nutrition and public health programmes promoting protein diversification indirectly support traded demand for pea protein ingredients.

- Trade facilitation agreements and tariff harmonisation measures affect cross-border movement of pea protein products.

- Environmental and sustainability policies that encourage plant-based proteins may stimulate import demand in certain jurisdictions.

Pea Protein Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 12.2% |

| Market Size in 2026 | USD 3.52 Billion |

| Market Size in 2027 | USD 3.95 Billion |

| Market Size in 2030 | USD 5.59 Billion |

| Market Size by 2035 | USD 9.93 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Pea Protein Market Segmental Analysis

Type Analysis

The pea protein isolate segment led the pea protein market in 2025, due to its multiple health benefits. Pea protein isolate is high in protein, is easily digestible, and is made from pure extraction methods, which are helpful to maintain the product quality. The market also observes growth due to high demand for the product by the growing population of vegans and vegetarians, fueling the growth of the market. Consumers seeking weight management and an enhanced lifestyle are in search of plant-based options to fuel the growth of the market.

The textured pea protein segment led the pea protein market in 2025, due to its versatility, allowing manufacturers to mimic the texture of meat options in plant-based form, fueling the growth of the market. The market also observes growth as the product can be used in various other food and beverage options due to its easy mixability without disturbing the taste of the food option. The segment also observes growth, as it is an ideal replacement for dairy-based options and is also an ideal meat alternative.

Form Analysis

The dry segment led the pea protein market in 2025, due to its easy maintenance, longer shelf life, and ease of mixing it in different types of food and beverages options to enhance its nutritional value. The market also observes growth as it helps to elevate the nutritional profile of baking mixes and protein shakes for enhancing the nutritional levels of vegans and vegetarians, who are always in search of plant-based options. The segment also observes growth as it helps to regulate the precise measurement and distribution, which is helpful to fuel the growth of the market. It is also easy for the transportation process to further fuel the market’s growth.

The liquid segment is expected to grow in the foreseen period due to its higher demand by consumers with a hectic lifestyle. Ready-to-drink formats, smoothie, and other pea protein beverages are easy to consume and also helpful to maintain the protein content of the day, fueling the growth of the market. The market also observes growth as it acts as an easy meal replacement for consumers with a busy lifestyle, further fueling the growth of the market.

Application Analysis

The food and beverages segment led the pea protein market in 2025, due to the continuous evolution and elevation of food and beverage manufacturing technology to enhance its nutritional profile. The market also observes growth as the pea protein does not have a flavor, which makes it easy to incorporate into different types of food and beverage options to maintain their flavor profile, along with enhancing their nutritional quality as well. A large number of companies are entering the plant-based meat manufacturing segment, further fueling the growth of the market.

The dietary supplements segment is expected to grow in the foreseeable period due to higher demand for different types of supplements to fulfill the daily nutritional requirements. The market also observes growth as it is an easy source of maintaining the nutritional profile and avoiding different types of lifestyle-related health issues, further fueling the growth of the pea protein market in the foreseeable period. Higher demand for plant-based supplements for weight management and muscle building, and enhanced demand for the sports and nutrition segment, also help to fuel the growth of the market.

Source Analysis

The yellow split peas segment led the pea protein market in 2025, due to its high protein content along with added nutritional benefits such as vitamins, minerals, and other essentials, fueling the growth of the market. It is an ideal source of plant-based protein and hence is highly opted for by vegans, vegetarians, and flexitarians, further fueling the growth of the market.

The lentils segment is expected to grow fastest in the foreseen period due to its high protein content, along with providing a variety in the plant-based options, further fueling the growth of the market. Availability of different types of lentil-based recipes providing variety and nutrition to vegans and vegetarians is another major factor fueling the market’s growth in the foreseeable period. The market also observes growth due to consumers demanding sustainability, versatility, and nutrient-rich options.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Key Companies Operating in the Global Pea Protein Market

- Nutri-Pea Ltd.: Nutri-Pea Ltd. is a Canada-based producer focused on sustainably sourced, non-GMO pea protein ingredients for food and nutrition applications. Its emphasis on clean-label processing and supply transparency strengthens its role as a reliable partner for North American manufacturers responding to rising demand for sustainable plant proteins.

- Shandong Jianyuan Group: Shandong Jianyuan Group is a large-scale Chinese manufacturer of pea protein isolates and concentrates serving both domestic and export markets. Its cost-efficient production and high-volume processing capacity make it a critical supplier supporting Asia-Pacific growth and global pea protein trade flows.

- Ingredion, Inc.: Ingredion, Inc. provides application-specific pea protein solutions designed to enhance texture, solubility, and sensory performance in food and beverage products. By enabling seamless reformulation for manufacturers, the company plays a key role in accelerating the commercial adoption of pea protein across mainstream applications.

- AGT Food and Ingredients Inc.: AGT Food and Ingredients Inc. operates as a vertically integrated pulse processor with strong capabilities in pea sourcing and ingredient manufacturing. Its control over raw material supply improves cost stability and scalability, reinforcing its strategic position in the global pea protein value chain.

- Glanbia Nutritionals: Glanbia Nutritionals supplies high-quality pea protein ingredients primarily for sports nutrition, dietary supplements, and functional foods. Leveraging deep nutrition science expertise, the company is helping position pea protein as a credible alternative to dairy-based proteins in performance-focused formulations.

- Cargill (including PURIS brand): Through its PURIS brand, Cargill offers specialty pea protein ingredients tailored for plant-based meat, dairy alternatives, and nutrition products. Its global scale, sustainability initiatives, and close integration with food manufacturers accelerate large-scale adoption of pea protein across diversified markets.

- Archer Daniels Midland Company (ADM): Archer Daniels Midland Company produces pea protein as part of its expanding plant-based protein portfolio, supported by extensive processing and distribution infrastructure. ADM’s ability to supply consistent, large-volume ingredients strengthens supply security for multinational food manufacturers.

- Sotexpro SA: Sotexpro SA is a European specialist in pea protein isolates and textured proteins, focusing on clean-label, allergen-free solutions. Its innovation-driven approach supports Europe’s growing demand for functional plant-based ingredients in meat alternatives and specialty foods.

- Kerry Inc.: Kerry Inc. incorporates pea protein into its broader portfolio of taste, nutrition, and functional solutions for food and beverage manufacturers. By combining protein functionality with flavor modulation, the company helps address sensory challenges that often limit pea protein adoption.

- Axiom Foods, Inc.: Axiom Foods, Inc. focuses on allergen-friendly, non-GMO pea protein ingredients targeting clean-label and specialty nutrition markets. Its positioning supports premium and health-focused product formulations where transparency and ingredient simplicity are key purchase drivers.

Segments Covered in the Report

By Type

- Pea Protein Isolate

- Pea Protein Concentrate

- Textured Pea Protein

- Pea Flour

By Form

- Dry

- Liquid

By Application

- Food & Beverages

- Dietary Supplements

- Animal Feed

- Bakery Products

- Beverages

- Others

By Source

- Yellow Split Peas

- Chickpeas

- Lentils

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5981

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://ww w.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.